Paycheck stub generator software offers a streamlined solution for managing payroll, eliminating the tedious manual process of creating individual pay stubs. These programs automate the generation of accurate and compliant pay stubs, saving businesses valuable time and resources. From calculating net pay to including necessary deductions and tax information, these software solutions provide efficiency and accuracy, minimizing the risk of errors and ensuring timely payment processing.

The convenience and benefits extend beyond simple pay stub creation, offering features such as employee data management and reporting capabilities.

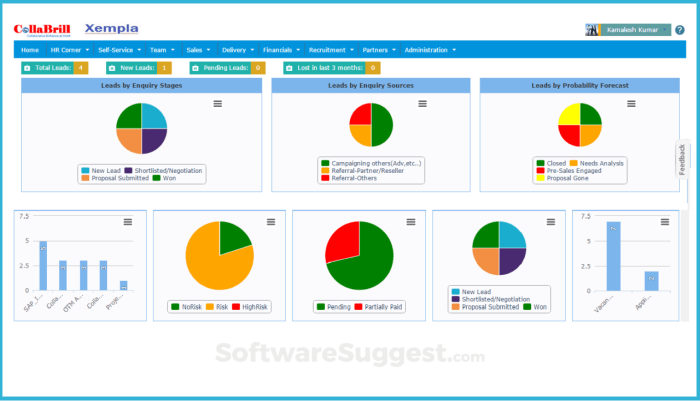

Beyond basic pay stub generation, many software packages integrate with accounting software and other HR systems for a more holistic payroll management solution. This integration simplifies data transfer, reducing manual data entry and the potential for discrepancies. Advanced features might include direct deposit capabilities, customizable stub templates, and robust reporting tools to help businesses track payroll expenses and compliance.

The choice of software often depends on the size of the business, its specific needs, and budget considerations.

In today’s fast-paced business environment, efficiency is paramount. Payroll processing, a crucial yet often time-consuming task, can be significantly streamlined with the help of paycheck stub generator software. This comprehensive guide explores the benefits, features, and considerations involved in choosing and utilizing such software, helping you make an informed decision for your business needs. We’ll delve into various aspects, from understanding the basics of paycheck stubs to exploring advanced features offered by leading software solutions.

Understanding Paycheck Stub Generators: More Than Just a Pretty Printout

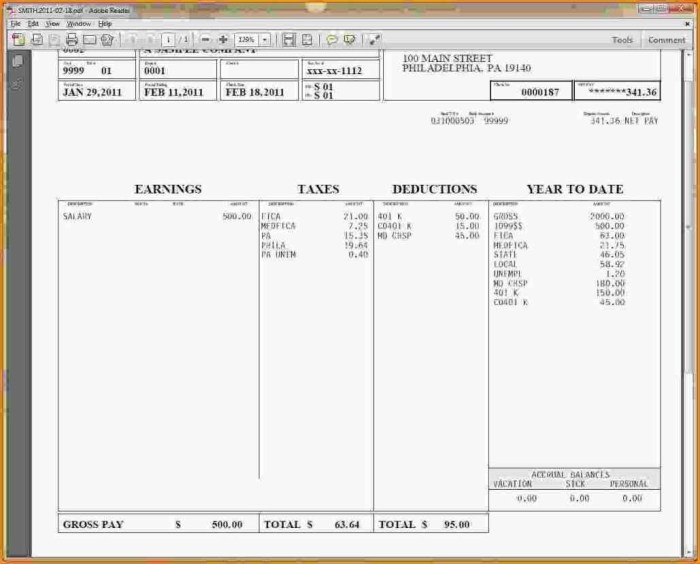

A paycheck stub generator is a software application designed to create accurate and professional-looking paycheck stubs (also known as pay slips or earnings statements). These stubs are not merely a record of payment; they serve as vital documentation for both employers and employees. They detail essential information such as gross pay, net pay, deductions (taxes, insurance, 401k contributions), and various other earnings and allowances.

Beyond simple generation, many advanced tools offer functionalities that improve overall payroll management.

Key Features of Effective Paycheck Stub Generator Software

- Accurate Calculations: The software should flawlessly calculate gross pay, net pay, and all deductions based on pre-defined tax rates, benefit plans, and other relevant parameters. Inaccurate calculations can lead to legal and financial complications.

- Customization Options: The ability to customize the stub’s appearance (logo, company information, font styles) is crucial for branding and professionalism. The software should allow for easy modification to meet specific company requirements.

- Multiple Payment Methods: Support for various payment methods, including direct deposit, checks, and even digital wallets, enhances flexibility and convenience.

- Employee Self-Service Portal: Many advanced solutions offer employee self-service portals, allowing employees to access their pay stubs, tax information, and other payroll-related documents online. This reduces administrative burden and improves transparency.

- Integration Capabilities: Seamless integration with existing accounting software, HR systems, and time tracking applications is highly desirable for efficient workflow management. This eliminates the need for manual data entry and minimizes errors.

- Reporting and Analytics: Comprehensive reporting and analytics features provide valuable insights into payroll expenses, tax liabilities, and other key metrics, aiding in better financial planning and decision-making.

- Data Security and Compliance: Robust security measures to protect sensitive employee data and compliance with relevant data privacy regulations (e.g., GDPR, CCPA) are paramount.

- Tax Calculation and Compliance: Accurate calculation of federal, state, and local taxes is critical. The software should be updated regularly to reflect changes in tax laws and regulations.

Choosing the Right Paycheck Stub Generator Software: Factors to Consider

Selecting the appropriate software depends on several factors, including the size of your business, budget, technical expertise, and specific payroll requirements. Consider the following aspects:

Source: free-printable-az.com

Scalability and Flexibility

Choose software that can scale with your business growth. If you anticipate significant growth, opt for a solution that can handle increasing numbers of employees and payroll complexities without performance issues.

User-Friendliness and Ease of Use

The software should be intuitive and easy to use, even for individuals with limited technical expertise. A user-friendly interface minimizes training time and improves overall efficiency.

Cost and Pricing Models

Paycheck stub generator software is available in various pricing models, including subscription-based plans, one-time purchases, and tiered pricing based on the number of employees. Carefully evaluate the cost-benefit ratio before making a decision.

Customer Support and Technical Assistance, Paycheck stub generator software

Reliable customer support is crucial. Ensure the vendor provides readily available technical assistance through various channels (phone, email, chat) to address any issues promptly.

Security and Data Protection

Prioritize software that employs robust security measures to protect sensitive employee data from unauthorized access, breaches, and data loss. Check for compliance with relevant data privacy regulations.

Benefits of Using Paycheck Stub Generator Software

Implementing paycheck stub generator software offers numerous advantages:

- Increased Efficiency: Automating the paycheck stub generation process saves significant time and effort compared to manual methods.

- Reduced Errors: Automated calculations minimize the risk of human errors, ensuring accurate payroll processing.

- Improved Accuracy: Automated systems reduce the likelihood of errors in calculating taxes, deductions, and net pay.

- Enhanced Compliance: Software often includes features to ensure compliance with relevant tax laws and regulations.

- Better Organization: Centralized payroll data management improves organization and accessibility.

- Cost Savings: While there’s an initial investment, the long-term cost savings from increased efficiency and reduced errors can be substantial.

- Improved Employee Satisfaction: Accurate and timely paychecks contribute to positive employee relations.

Frequently Asked Questions (FAQs)

- Q: Is paycheck stub generator software suitable for small businesses? A: Absolutely! Many solutions cater specifically to small businesses, offering affordable and user-friendly options.

- Q: Can I generate multiple pay stubs simultaneously? A: Yes, most software allows for batch processing, enabling the simultaneous generation of pay stubs for multiple employees.

- Q: What type of data do I need to input into the software? A: Typically, you’ll need employee information (name, address, social security number), hours worked, pay rate, and details about deductions (taxes, insurance, etc.).

- Q: How secure is my employee data? A: Reputable software providers employ robust security measures, including encryption and data backups, to protect sensitive information.

- Q: What if I need help using the software? A: Most vendors offer customer support via phone, email, or online chat to assist with any technical issues or questions.

- Q: Can I customize the look of my pay stubs? A: Yes, many software solutions allow for customization of the pay stub’s appearance, including logo, company information, and font styles.

- Q: What are the legal requirements for paycheck stubs? A: Legal requirements vary by location. It’s crucial to consult with legal and tax professionals to ensure compliance with all applicable laws and regulations in your area.

Conclusion: Embrace Efficiency with Paycheck Stub Generator Software

Implementing paycheck stub generator software is a strategic move towards streamlining payroll processes, improving accuracy, and enhancing overall efficiency. By carefully considering the factors Artikeld in this guide, you can select a solution that perfectly aligns with your business needs and contributes to a more efficient and effective payroll management system. Don’t hesitate to explore the various options available and choose the software that best fits your budget and long-term goals.

References

While specific software recommendations are avoided to maintain objectivity, you can research reputable payroll software providers by searching online for terms like “best payroll software,” “payroll software comparison,” and “pay stub generator software reviews.” Always verify the software’s features, security measures, and customer support before making a purchase decision. Consult with legal and tax professionals to ensure compliance with all relevant regulations.

Consider exploring resources from the IRS and your state’s labor department for information on payroll tax regulations and compliance.

Call to Action: Ready to optimize your payroll process? Start exploring paycheck stub generator software options today and experience the benefits of streamlined payroll management!

In conclusion, paycheck stub generator software presents a compelling solution for businesses of all sizes seeking to optimize their payroll processes. By automating pay stub creation, these programs improve efficiency, accuracy, and compliance. The integration capabilities and advanced features offered by many solutions further enhance their value, making them an indispensable tool for modern payroll management. The benefits extend beyond cost savings, contributing to a more streamlined and organized HR workflow.

Answers to Common Questions

What are the common features of paycheck stub generator software?

Common features include automatic calculations of net pay, deduction management (taxes, insurance, etc.), customizable templates, employee data management, reporting capabilities, and often integration with accounting or HR software.

Is paycheck stub generator software secure?

Reputable software providers prioritize data security through encryption and other measures to protect sensitive employee information. It’s crucial to choose software from established providers with a strong security track record.

How much does paycheck stub generator software cost?

Pricing varies widely depending on the features, scalability, and provider. Options range from free (often limited) versions to subscription-based models with varying monthly or annual fees.

Source: softwaresuggest.com

Can I use paycheck stub generator software for both employees and independent contractors?

Many programs offer flexibility to generate pay stubs for both employees and independent contractors, though the specific requirements and information included may differ.