Sales tax compliance software is revolutionizing how businesses manage their sales tax obligations. Navigating the complex web of state and local tax laws can be daunting, leading to costly errors and penalties. However, sophisticated software solutions are emerging to automate much of this process, offering features like tax rate calculation, exemption management, and automated filing. This allows businesses of all sizes to focus on growth, rather than getting bogged down in administrative complexities.

The benefits extend beyond simple compliance, offering insights into sales data and potentially identifying areas for improved efficiency and profitability.

These software solutions often integrate with existing accounting systems, streamlining workflows and minimizing data entry. Features like real-time tax rate updates ensure accuracy, and robust reporting capabilities help businesses demonstrate compliance to auditors. The choice of software depends on the specific needs of the business, from small businesses with simple needs to large enterprises managing sales across multiple states and jurisdictions.

Source: salestaxdatalink.com

Careful consideration of features, scalability, and integration capabilities is crucial for selecting the right solution.

Navigating the complex world of sales tax can be a daunting task for businesses of all sizes. Staying compliant with ever-changing state and local regulations requires meticulous record-keeping, accurate calculations, and timely filings. This is where sales tax compliance software steps in, offering a powerful solution to simplify this intricate process and minimize the risk of costly penalties.

Understanding the Importance of Sales Tax Compliance

Sales tax compliance is crucial for businesses operating in multiple jurisdictions. Failure to accurately collect and remit sales taxes can lead to significant financial penalties, legal repercussions, and damage to your business reputation. These penalties can range from back taxes and interest to legal fees and even criminal charges in severe cases. The complexity arises from the varying tax rates, rules, and exemptions across different states, counties, and even cities.

A single error can trigger a cascade of problems.

Key Challenges in Manual Sales Tax Management, Sales tax compliance software

- Complex Tax Laws: Staying updated on constantly evolving sales tax laws across multiple jurisdictions is a significant challenge.

- Manual Calculation Errors: Human error is inevitable when calculating sales tax manually, leading to inaccuracies and potential audits.

- Time-Consuming Processes: Manual data entry, reconciliation, and filing are incredibly time-consuming, diverting resources from core business activities.

- Lack of Real-time Data: Manual systems lack real-time visibility into sales tax liabilities, making it difficult to proactively manage compliance.

- Increased Audit Risk: Inaccurate records significantly increase the risk of audits and subsequent penalties.

How Sales Tax Compliance Software Solves These Challenges

Sales tax compliance software automates many of the complex tasks associated with sales tax management, offering a range of features designed to streamline the entire process. These features include:

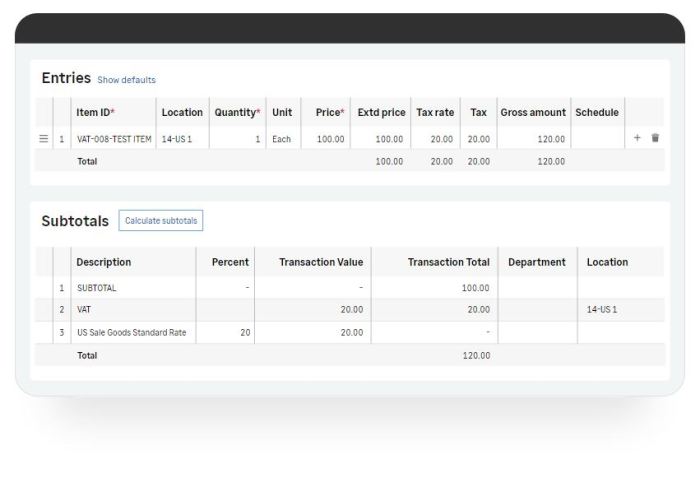

Core Features of Sales Tax Compliance Software

- Automated Tax Rate Calculation: Accurately calculates sales tax based on product, location, and applicable exemptions in real-time.

- Nexus Determination: Identifies and manages sales tax nexus, determining which states your business is required to collect sales tax in.

- Sales Tax Reporting: Generates accurate and compliant sales tax returns for various jurisdictions, reducing the risk of errors.

- Data Integration: Seamlessly integrates with accounting software and e-commerce platforms for efficient data flow.

- Audit Trail Management: Provides a comprehensive audit trail, simplifying the audit process and ensuring compliance.

- Tax Rate Updates: Automatically updates tax rates as laws change, ensuring continuous compliance.

- Exemption Management: Handles various sales tax exemptions efficiently and accurately.

- Threshold Monitoring: Alerts businesses when they approach sales tax filing thresholds.

- Multi-State Tax Compliance: Simplifies sales tax compliance for businesses operating in multiple states.

- Return Filing: Some software even offers direct e-filing capabilities to tax authorities.

Choosing the Right Sales Tax Compliance Software

Selecting the appropriate sales tax compliance software depends on your specific business needs and complexity. Consider the following factors:

Key Considerations When Selecting Software

- Business Size and Complexity: Choose software that scales with your business growth and handles the volume of transactions you process.

- Number of Jurisdictions: If you operate in multiple states or countries, ensure the software supports those jurisdictions.

- Integration Capabilities: Check for compatibility with your existing accounting software and e-commerce platforms.

- Reporting and Analytics: The software should provide comprehensive reporting and analytics to track sales tax liabilities and identify trends.

- Customer Support: Reliable customer support is crucial for addressing any issues or questions you may have.

- Cost and Pricing Model: Compare pricing models (subscription, per-transaction, etc.) to find the most cost-effective option.

- Security and Data Protection: Ensure the software provider prioritizes data security and compliance with relevant regulations.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about sales tax compliance software:

- Q: Is sales tax compliance software necessary for small businesses? A: Even small businesses operating in multiple states or with significant online sales should consider sales tax compliance software to ensure accuracy and avoid penalties.

- Q: How much does sales tax compliance software cost? A: Costs vary depending on the features, number of users, and the provider. Expect to pay a monthly or annual subscription fee.

- Q: Can sales tax software integrate with my existing accounting system? A: Many software solutions offer seamless integration with popular accounting platforms like QuickBooks and Xero.

- Q: What if my business operates internationally? A: Some software providers offer international sales tax compliance features, but this is often a more specialized and potentially higher-cost solution.

- Q: How do I know if a sales tax software is reliable and reputable? A: Look for established providers with positive customer reviews and a proven track record. Check for industry certifications and security measures.

- Q: Does the software handle tax rate updates automatically? A: Reputable sales tax software automatically updates tax rates as changes occur, ensuring ongoing compliance.

Conclusion

Implementing sales tax compliance software is a strategic investment that protects your business from the financial and legal risks associated with inaccurate sales tax calculations and filings. By automating complex tasks, providing real-time data, and ensuring accuracy, this software empowers businesses to focus on growth while maintaining full compliance. Choosing the right software involves careful consideration of your specific needs and a thorough evaluation of available options.

Resources

Call to Action

Ready to simplify your sales tax compliance and reduce your risk? Explore the leading sales tax compliance software solutions available today and find the perfect fit for your business. Request a demo or contact a sales representative to learn more.

In conclusion, sales tax compliance software provides a critical advantage in today’s business environment. By automating tedious tasks, ensuring accuracy, and providing valuable insights, these solutions empower businesses to maintain compliance effortlessly. The time and cost savings alone make the investment worthwhile, freeing up valuable resources to focus on core business functions and strategic growth. As tax laws continue to evolve, the importance of utilizing such software will only increase, making it an essential tool for any business operating in a multi-state or multi-jurisdictional environment.

Source: co.za

FAQ Compilation

What are the typical costs associated with sales tax compliance software?

Costs vary greatly depending on the vendor, features, and number of users. Expect a range from monthly subscription fees for smaller businesses to more substantial annual contracts for larger enterprises with complex needs.

How do I choose the right sales tax compliance software for my business?

Consider factors such as your business size, sales volume, number of states/jurisdictions you operate in, existing accounting software integrations, and budget. Look for software with features that directly address your compliance needs and provide robust reporting capabilities.

Can sales tax compliance software integrate with my existing accounting software?

Many solutions offer seamless integration with popular accounting platforms like QuickBooks and Xero, allowing for efficient data transfer and reduced manual data entry.

What happens if my sales tax software malfunctions or encounters an error?

Reputable vendors typically offer customer support to assist with troubleshooting and resolving any issues. Check the vendor’s support policies and reputation before committing to a particular solution.